- This event has passed.

Show Notes

July 29, 2021

Impossible Question

Click here for the impossible question.

Opening Comments

Dan Meurer with his sister, Anne, joined John in Studio today. Listen here.

National Chicken Wing Day

National Chicken Wing Day Activities. Article here.

Ron Popeil

Ron Popeil, Ronco Founder And ‘Informercial King,’ Dead At 86. Article here.

Comments here part 2. Mobile users begin at 12:01

A New Word

Hetero life mate meaning.

Comments here. Mobile users begin at 26:41

Jay and Silent Bob Snoogans Sweatshirt: Click here.

John from Cheyenne. Comments here. 29:42

Joe Biden the Truck Driver

JOE’S WHEELIE BIG LIE? Career politician Biden mocked for claiming he used to drive an 18-wheeler truck as critics say he ‘lives in fantasy land’. Video clip here.

Comments here. Mobile users begin at 42:29

White House Press Conference

Returning to lockdowns and school closures. Comments and Twitter recording here. Mobile users begin at 46:08

Colorado and the Silver Crash: The Panic of 1893

A catastrophic depression engulfed Colorado in 1893. The government’s decision to adopt the gold standard and stop buying silver hit the mining industry like a cave-in. Book by the author John Steinle “Colorado and the Silver Crash: The Panic of 1893″ here.

Interview here. Mobile users begin at 1:23

Steve House

This week there has been a fair amount of data regarding breakthrough cases on CoVid and it is becoming increasingly clear that the US is really cooking the books. The article below proves Fauci is lying about the 99% unvaccinated part just with his own numbers. Article here.

Interview

Part 1 here. Mobile users begin at 13:07

Part 2 here. Mobile users begin at 29:31

Part 3 here. Mobile users begin at 41:24

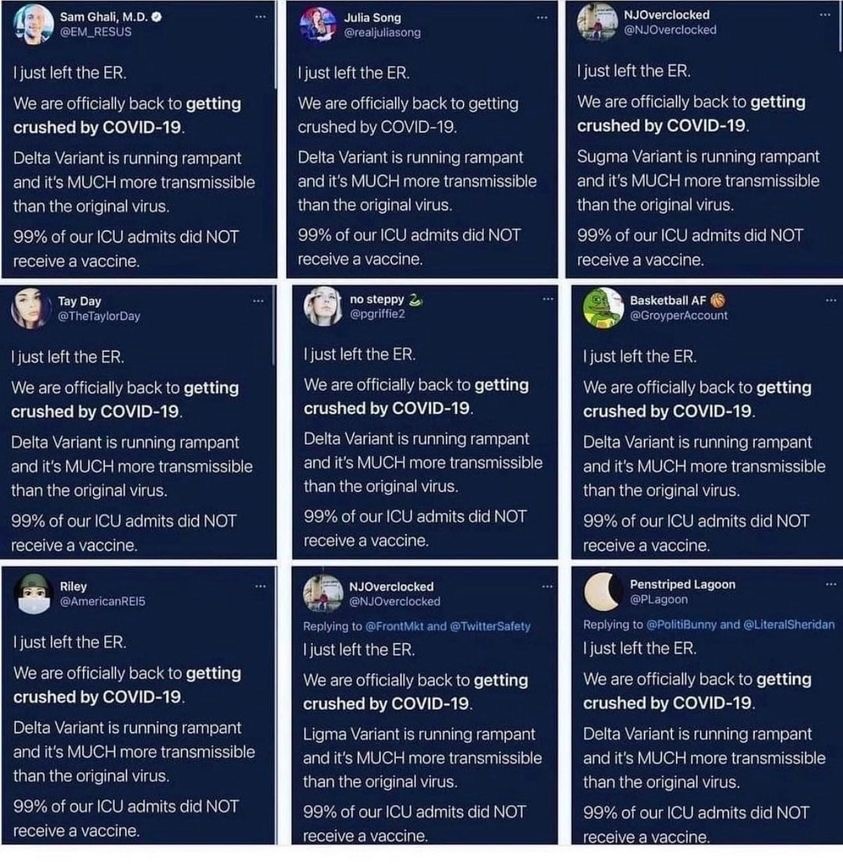

You can find similar displays of robotically generated comments on Facebook where the identical comment will appear on multiple different Facebook pages but all posted under different names.

You should be asking yourself: Who is doing this, who is paying for it, and why.

Comments here.

Sent in from Jersey Joe

Covid and the Numbers

From Jersey Joe:

At the height of the pandemic in the US. the reported death rate (daily deaths divided by REPORTED new daily cases) was 1.4% (Seven day average of 253,000 new daily cases per day divided by a peak seven-day daily death rate of 3,500). As low as that figure was, if you accept the CDC estimate that there were actually 8X as many actual cases of Covid infections than those confirmed by testing, that fatality rate would drop to 0.18%.

Now let’s look at the current fatality rate for the Delta variant. Right now the seven-day average rate for reported new cases is 67,293. The seven-day average fatality rate is 303. That yields a case fatality rate of just 0.45% for TESTED & CONFIRMED cases. 0.45% divided by 1.4% is just 32%.

That means that the reported case fatality rate for the Delta variant is less than 1/3 that of the original Covid 19 virus. If you also apply the 8X CDC actual vs reported case factor to that data, the fatality rate drops to less than 0.06% (6 hundredths of 1 % = 6 fatalities per 1,000 infections).

John’s comments here. Mobile users begin at 1:41

“The Delta variant is not going to kill us off.”

Joined the Conversation

Craig from Wheatridge on the Delta variant and the false narrative. The Craziness of the government and its inefficiency. CDOT and its troubles. Comments here. Mobile users begin at 3:52

Randy called in about CDOT and where is this money going when property taxes have doubled. Comments here. Mobile users begin at 16:35

Conrad called in about covid becoming a national emergency. Comments here. Mobile users being at 28:23

Scott Garliss

The European Central Bank said it’s going to increase the amount of money its putting in the financial system. It’s also going to maintain easy-money policies for longer.

The Fed also announced the introduction of a new repurchase facility yesterday. It will basically make $1 trillion available in the overnight lending markets, $500 B domestically and foreign.

These facilities are designed to increase access to cash. It’s an interesting move when many money managers are using the Fed’s reverse repurchase facility currently to store $1 trillion worth of cash. Could be a signal it’s getting ready to change policy direction. Both of these items could portend a stronger dollar – more euros and fewer dollars.

If that plays out, it could ease some of the inflation dynamics in this country as a stronger dollar has more buying power.

Pelosi and a lifetime of trading. Article here.

Interview here. Mobile users begin at 29:18